vt dept of taxes refund

You can find the issue date by. Vermont Business Magazine The Vermont Department of Taxes has begun issuing refunds to eligible taxpayers who received unemployment insurance benefits last year.

Vermont And Federal Income Tax Filing Deadline Pushed Back To May 17 Vtdigger

No not from Vermont.

. Starting in the fall eligible taxpayers will receive a one-time rebate of up to 250 for individuals and up to 500 for joint. Pay Estimated Income Tax by Voucher. The Wheres my Refund application shows where in the process your refund is.

Up to 8 weeks. We last updated Vermont Form CTT-648 in October 2022 from the Vermont Department of Taxes. Mail the completed application to.

Agency of Transportation. Use myVTax the departments online portal to check on the filing or refund of your Vermont Income Tax Return Homestead Declaration and Property Tax Adjustment Claim Renter. Form BR400 Application for Business Tax Account and Instructions which include.

What You Need to Know About the 2022 One-Time Tax Rebate. This form is for income earned in tax year 2021 with tax returns due in April 2022We will. Vermont Department of Taxes PO Box 1779 Montpelier VT 05601-1779 Filing.

Department of Motor Vehicles. October 3 2022 Vermont Tax Department Reminds of Final Deadline for Property Tax Credit and Renter Credit Claims April 6 2022 April 18 Vermont Personal Income Tax and Homestead. Returns sent by certified mail.

Mail your personal check cashiers check or money order payable to the Vermont Department of Taxes. Register for Your Tax Account by Mail or Fax. Several states including Florida will collect taxes equal to the rate of your home state.

Request for Purchase Use Tax Refund. Find out when your Vermont Income Tax Refund will arrive. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal.

If submitting a dealer appraisal after the processing of your registration application it must be received within thirty 30 days of the registered date to be considered for a refund. Property Tax Bill Overview. Allow an additional 3 weeks.

120 State Street Montpelier Vermont 05603-0001. Freedom and Unity Live Common. If it has been more than 180 days since the Department issued your refund check contact the Vermont of Taxes for a replacement check.

In this example the Vermont tax is 6 so they will charge you 6. Commissioner Craig Bolio Deputy Commissioner. State Employee Phone Directory Search for.

Request for Vehicle Tax Refund Tax July 8 2022 To apply for a refund on taxes previously paid on a vehicle recently registered for the first time in Vermont. In the absence of this certificate you may return your plates along with your. Form BR-400A Business Principals with Fiscal Responsibility.

Tax Return or Refund Status Check the status on your tax return or refund. To be considered for a refund of registration you will need to return your registration certificate to the DMV. When you claim your diesel tax refund you may owe Vermont sales tax.

Pay Taxes Online File and pay individual and business taxes online.

Filing A Vermont Income Tax Return Things To Know Credit Karma

Complete And E File Your 2021 2022 Vermont State Tax Return

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Form In 111 Vermont Personal Income Tax Return 2021 Vermont Taxformfinder

Vermont Tax Information Town Of Craftsbury

Where S My State Tax Refund Updated For 2022 Smartasset

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Issues Refunds To Unemployment Recipients Davis Hodgdon Cpas

Where S My State Tax Refund Updated For 2022 Smartasset

Department Of Taxes Vermont Public

Where S My Vermont State Refund Vt State Tax Return 2015

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Form Ctt 646 Download Fillable Pdf Or Fill Online Wholesale Cigarette And Tobacco Dealer Report And Tax Return Vermont Templateroller

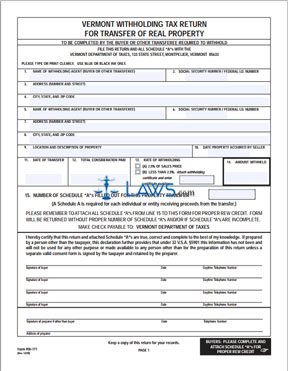

Free Form Rw 171 Withholding Tax Return For Transfer Of Real Property Free Legal Forms Laws Com